Tickmill Review 2024

28

Today I’d like to tell you in an actual Tickmill review 2024 about this very reliable CFD and forex broker. So, you will know from this review about the broker’s history and its licenses, account types, trading instruments, free Tickmill welcome bonus, broker’s contests and promotions, trading platform, deposit and withdrawal options, etc. Of course, I’ll tell you how to get the $30 welcome forex bonus absolutely free. So, if you will open a special Tickmill welcome account then the broker credits 30 USD as a free bonus to the balance of your account.

Tickmill welcome no deposit bonus

Tickmill started its promotion of a $30 welcome bonus without a deposit in February 2024. This free bonus gives the opportunity to trade using free trading capital, without having to make a deposit.

How to get Tickmill welcome bonus in 2024

Do not forget that only new clients may receive this money and use it for trading without any risk to their own money. This free $30 bonus may help new traders to check the quality of the Tickmill trading service. So, let’s see how to get Tickmill welcome no deposit bonus without verification in 2024 (by the way, it’s a very simple and quick offer in comparison with other free welcome forex offers from the global bonus list at my site):

1) Standard stage, you should register a Welcome account under Tickmill Ltd (FSA SC Regulated) or log in Tickmill Welcome account, if you have already opened it. Go to the broker’s official site (click on the banner below):

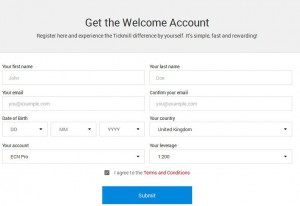

2) Scroll the site page to the bottom. You will see there the registration form for opening the welcome trading account. Please, note that you must fill in only the Latin letters (English letters). Also, you should take care not to make a mistake in writing your last name, first name, and date of birth. You can also choose the leverage for your Tickmill bonus account that suits you, but remember that with $30 in your balance and small leverage, you will not earn much.

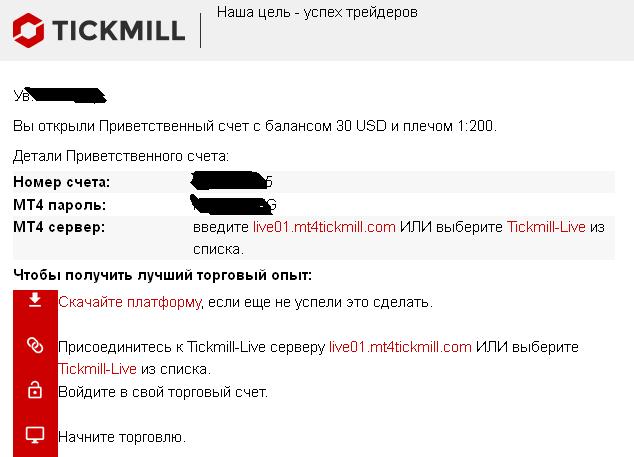

3) In 10 minutes after submitting the registration form you should go to your email box and check the incoming mail. There will be a letter from the broker. In this letter, you will get Tickmill login details for your welcome account (number, password, and address of the MT4 server) and confirmation that the Tickmill no-deposit bonus was added automatically to the Welcome Account. There also will be a link for downloading the MT4 terminal:

4) You may start your trading.

Welcome bonus terms and conditions

As with every no-deposit bonus the Tikmill welcome bonus has terms and conditions. Let’s list the most important terms and conditions of this Tickmill no deposit bonus in 2024:

- The Welcome Account is not available for residents of Belarus, Bangladesh, Côte d’Ivoire, Colombia, Algeria, Egypt, Brazil, Angola, Argentina, Bolivia, Jordan, Hong Kong, South African Republic, China, Indonesia, Lebanon, India, LN, Sri Lanka, Libya, Lesotho, Macao SAR China, Morocco, Thailand, Palestinian Territories, Mexico, Tunisia, Taiwan, Vatican City, Venezuela, South Africa, El Salvador, Mozambique, Chile, Costa Rica, Dominican Republic, Ecuador, Guatemala, Honduras, Paraguay, Peru, Uruguay, Vietnam, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom, Ghana, Zimbabwe, Australia, Austria, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Greenland, Hungary, Iceland, Ireland, Italy, Kosovo, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, San Marino.

- The trader is not allowed to use Expert Advisors on the Welcome account.

- The Welcome account trading conditions are similar to the Tickmill Pro account trading conditions.

- You have the option to change the leverage on this bonus Account.

- The Welcome Account is available for trading for 60 days. Once 60 days have passed, you will get an additional 14 days to withdraw the earned profit from this bonus.

- Tickmill no-deposit bonus cannot be withdrawn or transferred from the Welcome account.

- Not less than $30 USD and not more than $100 of profit can be transferred from the Welcome account to the Client’s Wallet. To do this transfer, the Client has to:

-register a real Tickmill account, using the same information used for registering the welcome account;

-upload the necessary identification documents required to validate the Client Area account (verification procedure);

-make a minimum deposit of $100 to the Tickmill Wallet.

-after depositing $100 in the Wallet, you should send an email to support@tickmill.com and request a transfer of bonus profit from the Welcome account to the Wallet.

The welcome bonus profit will be transferred from Tickmill no deposit bonus account to the balance of the Wallet and can be withdrawn immediately by using any of the available withdrawal options. Or, you may use it for usual trading.

Who is broker Tickmill?

Tickmill is a well-known forex broker offering a wide range of services to traders around the world. Founded in 2014, Tickmill has since become a recognized market leader and innovator, gaining a reputation for strong financial performance and stable growth.

Tickmill’s team is made up of experienced traders who have been working in the major financial markets since the 90s. This extensive experience allows Tickmill to understand traders’ needs from the inside out, helping the company provide both retail and institutional clients with an exceptional trading environment that allows them to fully realize their ideas.

What sets Tickmill apart in the market is its commitment to offering unlimited trading without requotes, allowing traders to utilize a variety of trading strategies such as scalping, hedging, arbitrage, advisors, and algorithms. The platform offers a wide range of trading instruments including forex, stock indices, commodities, bonds, cryptocurrencies, and stocks.

With a broad customer base, Tickmill boasts more than 327,000 satisfied customers and over 668,000 registered trading accounts in 2024. Tickmill Group has executed an impressive 538 million trades and employs more than 250 professionals worldwide.

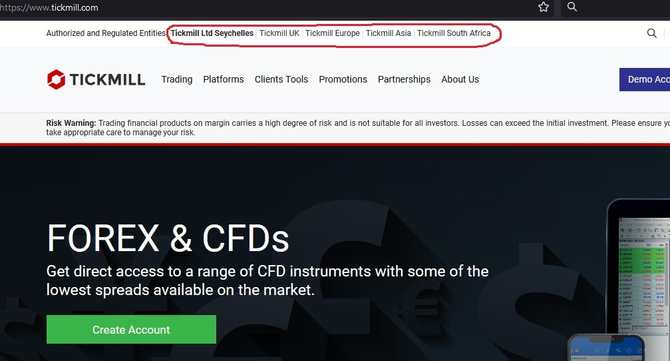

In terms of regulation, Tickmill Group operates under the supervision of reputable financial jurisdictions. Tickmill is a trademark of Tickmill Group, which includes Tickmill Ltd, Tickmill UK Ltd, Tickmill Europe Ltd, Tickmill Asia Ltd, and Tickmill South Africa (Pty) Ltd. Tickmill Ltd is regulated by the Financial Services Authority of Seychelles (FSA) and also acts as a securities dealer. Tickmill UK Ltd operates under the authorization and regulation of the Financial Conduct Authority (FCA) in the United Kingdom. Tickmill UK Ltd also has an office regulated by the Dubai Financial Services Authority (DFSA). Tickmill Europe Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) as a CIF limited company. Tickmill Asia Ltd operates under the authorization and regulation of the Labuan Financial Services Authority. Finally, Tickmill South Africa (Pty) Ltd is authorized and regulated by the Financial Services Supervisory Authority (FSCA). In South Africa, the FSCA acts as a dedicated market authority that seeks to improve the efficiency and integrity of financial markets.

With its well-regulated structure and diverse offerings, Tickmill continues to provide services to traders seeking a safe and secure trading environment in the forex market and beyond.

Is Tickmill regulated?

Tickmill operates under strict regulation in several respected financial jurisdictions:

- Tickmill Ltd, one of the Group’s entities, is regulated by the Seychelles Financial Services Authority (FSA) as a securities dealer. With license number SD008, Tickmill Ltd complies with the strict regulatory requirements of the FSA.

- Tickmill UK Ltd is another subsidiary authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom. According to registration number 717270, the company adheres to the strict rules and regulations set by the FCA.

Tickmill UK Ltd also has an office regulated by the Dubai Financial Services Authority (DFSA). This office, operating under registration number F007663, enforces the rules governing financial services in the Dubai International Financial Center. - Tickmill Europe Ltd operates as a CIF limited company and is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC). With license number 278/15 and registration number 340249, the company supports CySEC’s mission to ensure investor protection through effective supervision.

- Tickmill Asia Ltd, another subsidiary, is authorized and regulated by the Labuan Financial Services Authority. With license number MB/18/0028 and company registration number LL14858, the company operates under the central authority for international business and financial services in Labuan.

- Finally, Tickmill South Africa (Pty) Ltd operates under the authorization and regulation of the Financial Sector Supervisory Authority (FSCA). The company, with registration number 2017/531268/07 and license number FSP 49464, operates under a special market authority in South Africa.

Tickmill account types

Tickmill offers 3 different types of trading accounts to meet the diverse needs of traders, regardless of their level of experience or trading strategy:

- Tickmill Pro account

This type requires a minimum deposit of $100 to the Tickmill account. It supports several base currencies including USD, EUR, GBP, ZAR, PLN, and CHF. Traders will love the very thin spreads starting at 0.0 pips, which is ideal for those looking for ultra-competitive trading conditions. The maximum leverage offered on this account type is 1:500, except for UK and EU clients where leverage is no more than 1:30 and 1:300 respectively. The commission for this account type is set at 2 per side per 100000 trades. Traders are free to use any strategy on the Pro account, and there is also the option to convert this type to a swap-free Islamic account. - Tickmill Classic account

It is another attractive choice with a required minimal deposit of $100. It supports the same base currencies as the Pro account and offers variable spreads starting at 1.6 pips. While there are no commissions for this account type, traders can still take advantage of favorable trading conditions and leverage up to 1:500 (1:30 for the UK traders and 1:300 for the EU traders). As with the Pro account, all trading strategies are allowed and traders can opt for the Islamic version of the classic account without swaps if required. The Classic account is not only suitable for traders of all levels but also offers a great start for forex trading. With ultra-fast order execution, this account allows traders to utilize a variety of trading strategies, making it a popular choice for beginners and experienced traders alike. - Tickmill VIP account

It is designed for high-volume traders and requires a minimum account balance of $50000. It supports the same base currencies as the other accounts and offers zero spreads starting at 0.0 pip. The commission for this Tickmill VIP account is impressively low at just 1 unit per side per 100000 trades. With a VIP account, traders can access a wide range of trading instruments including currency pairs, stocks, indices, commodities, and cryptocurrencies. The maximum leverage offered on this account type is 1:500, except for UK and EU clients where leverage is no more than 1:30 and 1:300 respectively. VIP clients also get the unique advantage of placing stop and limit orders close to market prices, which increases their trading flexibility. If needed, you can opt for the Islamic version of the VIP account without swaps.

Some important details about Shariah-compliant Islamic accounts. These swap-free accounts have the same trading conditions as regular accounts, the only difference being that there are no overnight swaps on the trading instruments. Traders can request Islamic status for any type of account, whether Classic, Pro, or VIP and subsequent accounts opened will automatically be converted to swap-free. Providing the option of Islamic accounts for those who abide by Sharia law, Tickmill truly prioritizes the interests of its customers and strives to provide the best trading experience possible.

So, the broker offers a wide variety of trading account types to a wide range of traders, from the highly competitive Pro account to the versatile Classic account with no commission. For large traders looking for exclusive terms and personalized treatment, the VIP account will provide zero spreads and minimal commissions.

Deposit and withdrawal options

Tickmill deposit options

Tickmill offers many convenient and safe ways to fund your trading account. Please note that all deposit methods are free of charge on Tickmill’s part, but intermediary banks or e-wallets may charge a fee. Available Tickmill deposit options:

- Bank wire transfer: Deposit in USD, EUR, GBP, PLN, CHF, and ZAR. The minimum deposit amount is $100, and the processing time is within 1 working day.

- Credit/Debit Card (Visa and Mastercard): Deposit in USD, EUR, GBP, and PLN. The minimum deposit amount is $100, and deposits are instant.

- Skrill: Deposit in USD, EUR, GBP, and PLN. The minimum deposit amount is $100, and deposits are instant.

- Neteller: Deposit in USD, EUR, GBP, PLN, and CHF. The minimum deposit amount is $100, and deposits are instant.

- PayPal: Deposit in USD, EUR, GBP, PLN, and CHF. The minimum deposit amount is $100, and deposits are instant.

- Trustly: Deposit in EUR, GBP, NOK, PLN, SEK, CZK, and DKK. The minimum deposit amount is $100, and deposits are instant.

- Dotpay: Deposit in PLN. The minimum deposit amount is $100, and deposits are instant.

- Sofort: Deposit in EUR and GBP. The minimum deposit amount is $100, and deposits are instant.

- Rapid Transfer by Skrill: Deposit in EUR, PLN, GBP, and USD. The minimum deposit amount is $100, and deposits are instant.

- Crypto payments: Deposit in BTC, ETH, or USDT. The minimum deposit amount is $100, and Tickmill account fundings are instant 24/7.

- Sticpay: Deposit in USD, EUR, and GBP. The minimum deposit amount is $100, and Tickmill account replenishments are instant.

- Fasapay: Deposit in USD and IDR. The minimum deposit amount is $100 or 1,500,000 IDR, and deposits are instant.

- UnionPay: Deposit in CNY. The minimum deposit amount is 700 ¥ or € / $ / £ 100, and deposits are instant.

- WebMoney: Deposit in USD and EUR. The minimum deposit amount is $100, and deposits are instant.

When making a deposit with Tickmill, make sure that the payment method you use is listed under your name and legally owned by you. Also, it is optimal that deposits are in the same currency as the currency of your Tickmill trading account to avoid conversion fees. Please, note that some deposit options are only available to residents of certain countries. Enjoy free and hassle-free deposits with Tickmill’s secure payment methods.

Tickmill withdrawal options

Tickmill provides a simple and secure process for withdrawing funds from your trading account. It is important to note that withdrawals are processed in the base currency of your wallet. While the broker does not charge withdrawal fees, it is important to check if intermediary banks or electronic payment systems charge any fees that are independent of Tickmill. Here are the available withdrawal options along with their characteristics:

- Bank wire transfer: Withdraw in USD, EUR, GBP, PLN, CHF, and ZAR. The minimum withdrawal amount is $25, and the processing time is within 1 working day.

- Credit/Debit Card (Visa and Mastercard): Withdraw in USD, EUR, GBP, and PLN. The minimum withdrawal amount is $25, and withdrawals are processed within 1 working day.

- Skrill: Withdraw in USD, EUR, GBP, and PLN. The minimum withdrawal amount is $25, and withdrawals are processed within 1 working day.

- Neteller: Withdraw in USD, EUR, GBP, PLN, and CHF. The minimum withdrawal amount is $25, and withdrawals are processed within 1 working day.

- PayPal: Withdraw in USD, EUR, GBP, PLN, and CHF. The minimum withdrawal amount is $25, and withdrawals are processed within 1 working day.

- Trustly: Withdraw in EUR, GBP, NOK, PLN, SEK, CZK, and DKK. The minimum withdrawal amount is $25, and withdrawals are processed within 1 working day.

- Dotpay: Withdraw in PLN. The minimum withdrawal amount is $25, and withdrawals are processed within 1 working day.

- Sofort: Withdraw in EUR and GBP. The minimum withdrawal amount is $25, and withdrawals are processed within 1 working day.

- Rapid Transfer by Skrill: Withdraw in EUR, PLN, GBP, and USD. The minimum withdrawal amount is $25, and withdrawals are processed within 1 working day.

- Cryptocurrency payments: Withdraw in BTC, ETH, or USDT. The minimum withdrawal amount is $25, and withdrawals are processed within 1 working day.

- Sticpay: Withdraw in USD, EUR, and GBP. The minimum withdrawal amount is $25, and withdrawals are processed within 1 working day.

- Fasapay: Withdraw in USD and IDR. The minimum withdrawal amount is $25, and withdrawals are processed within 1 working day.

- UnionPay: Withdraw in CNY. The minimum withdrawal amount is $25, and withdrawals are processed within 1 working day.

- WebMoney: Withdraw in USD and EUR. The minimum withdrawal amount is $25, and withdrawals are processed within 1 working day.

Please make sure that the withdrawal request is made from the same Tickmill trading account where the deposit was made. This ensures the smooth processing of your withdrawal. With convenient withdrawal options, you can easily access your funds.

Note that there is a required broker rule when withdrawing funds from Tickmill, which is to execute withdrawals using the same method used to fund your account. Here is an example of how withdrawals are processed if the withdrawal and deposit methods are different.

If you used a credit/debit card to deposit funds into your Tickmill account, first a withdrawal amount equal to the total deposits made with that card will be withdrawn to that card. If you have a profit that exceeds the amount deposited, then the difference can be withdrawn to any withdrawal method you choose.

For example, if you deposited $200 using a credit/debit card, traded, made a profit of $500, and requested a withdrawal of $500, then you would receive $200 on your card first and the remaining $300 would be withdrawn to the payment method of your choice.

Tickmill trading platforms

Tickmill offers traders a wide range of trading platforms (MT4, MT5, Webtrader), each aimed at utilizing different trading strategies and approaches.

MetaTrader 5 (MT5) stands out as the leading forex trading platform, providing a wide range of features and tools. Traders can access CFDs on a variety of assets including Forex, stock indices, stocks, commodities, bonds, and cryptocurrencies. MT5 supports all types of trading orders, including limit, stop, and stop-limit orders, giving traders the flexibility to implement their strategies. The platform also boasts a wide range of built-in indicators (38+) and customizable charts (21 timeframes) to enhance technical analysis capabilities. Traders can utilize algorithmic applications such as Expert Advisors, trading robots, and copy-trading to ensure automated and efficient trading. In addition, MT5 includes a built-in economic calendar that informs traders about the most important market events.

On the other hand, Tickmill’s MetaTrader 4 (MT4) offers a familiar and accessible trading experience. In MetaTrader 4, traders have access to Forex CFDs, stock indices, commodities, bonds, and cryptocurrencies. MT4 supports EA trading via VPS, allowing for seamless connection of automated strategies. MT4’s advanced technical analysis contains over 50 indicators and customizable charts in 39 languages, providing comprehensive tools for market analysis. In addition, MT4 offers trading signals with an advanced notification system that keeps traders up-to-date with market events.

For traders looking for flexibility and simplicity, Tickmill’s MetaTrader 4 WebTrader platform is an excellent choice. This web-based version of MT4 allows trading directly from a browser, giving traders instant access to the markets anytime, anywhere. The WebTrader platform supports real-time quotes, customizable price charts, and nine different timeframes, allowing traders to make informed trading decisions. With securely encrypted data transmission, traders can confidently execute orders, manage risk, and access full trading history.

If to compare MetaTrader 4 and MetaTrader 5 for Tickmill trading, we should note that both platforms support multiple order execution types and pending order types, but there are slight differences in the number of supported technical indicators, timeframes, and analytical objects. Also, MT5 boasts a multi-threaded strategy tester, trading signals, and trade copying capabilities, while MT4 supports a single-threaded strategy tester and does not support trading signals or trade copying. In addition, MT5 has a built-in economic calendar feature that is not available in MT4.

Frequently Asked Questions

How to login tickmill account?

The broker provides services all over the world and due to this fact clients often have difficulties with log in to Tickmill client area. What exactly is the difficulty? Tickmill operates several regulated entities and there is a separate account login page for each of them. Clients during registration of an account are automatically redirected to the jurisdiction corresponding to their geolocation without even realizing it. When they start trying to log in to their Tickmill account after registration, some difficulties may arise.

So, open the main page of the official Tickmill website (www.tickmill.com) and look at the top, there are links to all current jurisdictions of the broker (Tickmill Ltd Seychelles, Tickmill UK, Tickmill Europe, Tickmill Asia, Tickmill South Africa). Simply click on what you need.

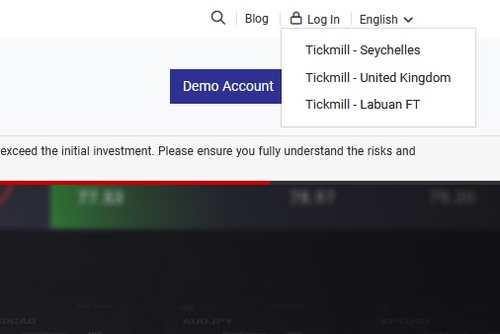

Look to the right upper corner of the page, there is a login button to your Tickmill account. When you hover your mouse over this button, you will see a drop-down list of login options. As of 2024 in my geolocation, there are 3 options: Tickmill Seychelles login, Tickmill United Kingdom login, and Tickmill Labuan FT login. Simply choose what you need.

If you couldn’t solve this problem, then here are the direct links to the relevant Tickmill account login pages:

- If the Tickmill account was registered under the jurisdiction of the United Kingdom, then for tickmill uk login you need to go to https://secure.tickmill.co.uk/users/login

- If the client registration was made under the jurisdiction of Seychelles, then use the link https://secure.tickmill.com/users/login for tickmill seychelles login.

- If the registration was made from the European Union, then use the link https://secure.tickmill.eu/login.

- If the registration was made from Asia (Labuan FT), then use the link https://secure.tickmill.asia/en/login.

What are the advantages of Tickmill?

Tickmill offers traders low spreads starting from 0.0 pips and an ultra-fast order execution speed of 0.15 seconds on average. Broker provides many options for instant depositing funds and quick withdrawals within one working day. Traders are allowed scalping, hedging, arbitrage, EAs, and algorithms.

What trading instruments does Tickmill offer?

The choice of trading instruments offered by the broker is quite large: Forex, Stock Indices, Commodities, Bonds, Cryptocurrencies, and Stocks.

What is Tickmill minimum deposit?

The Tickmill minimum deposit is only $100 for the Standard account and Pro Account.

What is the Tickmill maximum leverage?

The maximum leverage offered on the Tickmill account is 1:500, except for UK and EU clients where maximum leverage is no more than 1:30 and 1:300 respectively.

How to contact the broker?

Sometimes, a trader may need his broker’s contacts for help or complaints. At this moment traders do not have the slightest reason to complain about the Tickmill scam or the broker’s service. But questions about working conditions, trading instruments, and problems with deposits or withdrawals appear pretty often, especially at the start of work. Below you will find all contacts for communication with Tickmill in different regions of the world.

- Phones:

+852 5808 7849 (Tickmill Ltd)

+60 16 299 9449 (Tickmill Asia Ltd)

+852 5808 7849 (Tickmill South Africa Ltd)

+44 203 871 3299 (Tickmill UK Ltd)

+357 25041710 (Tickmill Europe Ltd) - Mail Addresses:

Tickmill UK Ltd

3rd Floor, 27 – 32 Old Jewry, London EC2R 8DQ, England

Tickmill Europe Ltd

Kedron 9, Mesa Geitonia, 4004 Limassol, Cyprus

Tickmill South Africa Ltd

The Pavilion, Cnr Dock and Portswood Rd, V and A Waterfront, 8001, Cape Town

Tickmill Ltd

3, F28-F29 Eden Plaza, Eden Island, Mahe, Seychelles

Tickmill Asia Ltd

Office No. 5, Unit 25, 1st floor Paragon Labuan, Jalan Tun Mustapha, 87007 Labuan F.T., Malaysia - Official Tickmill site:

https://www.tickmill.com/ - Customer support email:

support@tickmill.com (Tickmill Ltd, Tickmill Asia Ltd, Tickmill South Africa Ltd)

support@tickmill.co.uk (Tickmill UK Ltd)

support@tickmill.eu (Tickmill Europe Ltd)

Good luck!

Hi!

Thank you for your review. I want to claim this Tickmill bonus, but I need to know one thing before. As I’ve read earlier, most brokers have a prerequisite about minimum deposit even for no-deposit accounts. Brokers declare such minimum account funding as one of the stages of verification procedures. So, what about the tickmill minimum deposit? Will be enough $100 for them? Will I lose my money if I will lose this $30 no-deposit bonus?

Hi, Ali Shenj!

Yes, $100 will be enough for the Tickmill minimum deposit. And, of course, you may use a $30 bonus without any risk to your own funds.

Why is it difficult to be verified by Tickmill even after providing the information needed…

And if I deposit the 100$ will I be able to withdraw both my deposit and profits from the Tickmill bonus all together. ???

Yes, there is a problem with Tickmill’s verification of new accounts. Its verification procedure is quite strict and not fast. But, you may try to write them and ask to hurry the verification process.

If you finish their condition about trading turnover and initial deposit, you may request money withdrawal from your account balance.

Hii! I like this broker. Tickmill is very reliable.

Have been trying to get my address verify over a month now but tickmill keeps on rejecting it,

Have you asked them about the reasons? As I know Tickmill rejects verification docs only for specific reasons.

Si je comprends bien il faut trader avec ce bonus sans dépôt pendant 90jours pour pouvoir transférer les bénéfices dans votre compte réel ?

Les conditions actuelles de cette promotion bonus de Tickmill sont les suivantes: vous pouvez échanger avec des fonds bonus pendant 60 jours maximum. Si votre profit actuel dépasse 30 $, vous pouvez le retirer du compte bonus Tickmill. Vous ne pouvez pas attendre 60 jours si vous avez déjà au moins 30 $ de profit commercial. Les bénéfices commerciaux ne peuvent être retirés du compte bonus qu’une seule fois. Après le premier retrait des bénéfices, le compte bonus Tickmill sera fermé.

I thought your aim is to help th poor that can’t afford the depositng , what is the 100 deposit for

It is one of the best forex bonuses.. I just withdrew 570usd and only made a 5usd deposit.. don’t be fooled by people’s negative comments some haven’t even tried to register in these brokers. Use these brokers to get a discount instead of depositing 100 usd you deposit 5usd. This was a life saver for me the discount thank me later.

Do you have a tickmill demo account

Jessie, tickmill allows to open demo accounts.

How can i transfare my profit from the welcome bonus account to my real account

Broon, read the tickmill welcome bonus conditions in my review. There you will find all necessary information about withdrawal your profit.

Hey guys how do we add and withdraw From the $30 account bonus

Hi i would like to join tickmill

It’s easy. Register at their site, open trading account and trade via Tickmill.

I need my tickmill real account logins

try to ask it from tickmill support

How long he will take me to get the 30 USD bouns? after open the account for me to start practicing.

Usually, during 1 days after verification.

Can i please get 30$ bonus

Yes, Victoria, you can get it. Just click on this link Tickmill $30 bonus and pass the registration procedure. And, if you will do this, Tickmill will credit this free bonus to your trading account.

can i please get the $30 bonus

of course, click on the broker banner and follow the instuction from this post.

How do we withdraw the $30 bonus?

William, you should see the Tickmill bonus conditions. There you will see all you need to withdraw the money.