FXopen Review 2024

1

Here you will get answers to all you have to know about the FXOpen, for example, whether is it still possible to claim FXOpen welcome no deposit bonus in 2024, or how to deposit your trading account, etc. The broker offers $10 as a welcome bonus for ECN TickTrader accounts from 2020. Not too big money in comparison with some huge offers from the free forex bonus list posted at my blog, but pay some attention to FXopen welcome bonus. Below I shall give you the actual Fxopen review, tell you all about registration of the ewallet for the FXopen account, stp account opening, other account types, verification procedures, no deposit bonus conditions, deposit and withdrawal options, trading platforms, etc. So, if you have not tried yet to trade via Fxopen or if you are just going to start your forex trading, then this review will be absolutely useful to you. So, let’s go.

How to register ewallet and get free FXopen bonus

1) The registration procedure on the FXopen official site is not too complicated, but it has its own peculiarities. So, click on the broker’s banner below and go to the main page of official site:

2) When main page of site will be opened, then move your mouse over the tab and click on “Bonuses” from the drop-down list:

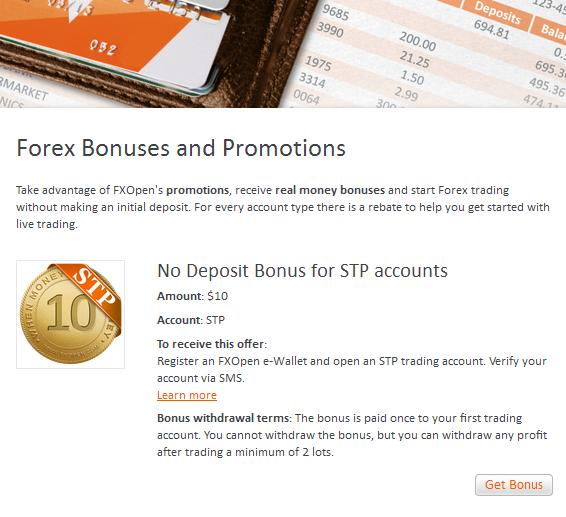

3) You will see special page with different FX open bonus offers actual in 2024. Look on the first position in the list, where will be written “No Deposit Bonus for STP accounts”, then click on the “Get Bonus” button:

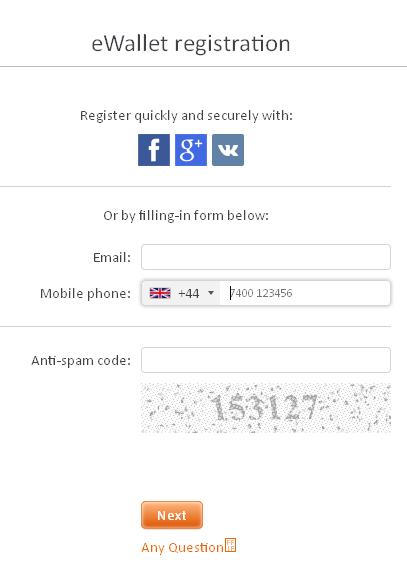

4) On the new page, if you have not still registered here, you need to click on the “Register” button. You will be redirectered to the FXopen registration page, where you can choose the most convenient registration way for you: fill the form via entering your e-mail and phone or use social media profiles for registration purposes (you may use Facebook, Google+ or VK):

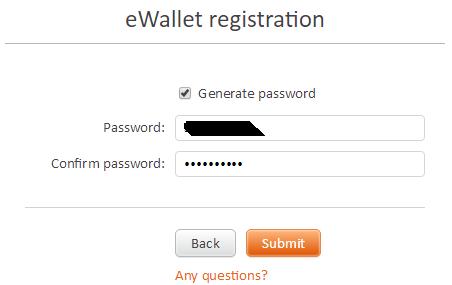

5) On the next page you see the second stage of the eWallet registration process. Here you will need to enter your own password or tick the box if you want that the password will be generated automatically:

After clicking on the “Submit” button, your eWallet will be registered. On the next page, you will see the important information which you should save, because you will need it later. You will see there your fxopen login (your registration e-mail is used for this purpose), the eWallet number, and four-digit pin number (it will be required if you will need to change the information in your personal profile, update financial information or withdraw the money).

6) Now you should check your email box. The confirming letter from the broker FXopen will be sent to your email. In this letter, you will find a special link. You need to click on it for confirming the correctness of the e-mail specified by you during the registration process.

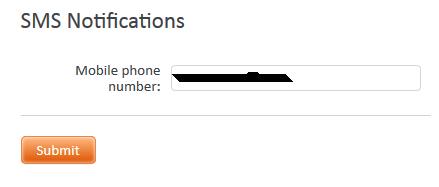

7) The next step in the registration’s procedure. For free receiving Fxopen no deposit welcome bonus you should pass your phone verification, which you used at the beginning of the registration. Phone verification is performed via SMS. Login My FXOpen area at broker’s website and go to the “Settings” section, then go to the “Security” section and then click on “SMS notification”. On the next page you will be asked to enter the mobile phone number, if you registered ewallet using social networks profile, and then click on the button “Submit”:

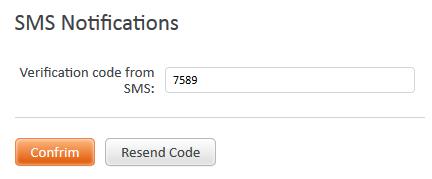

You will receive to your phone the SMS with a verification code. Enter this verification code in the appropriate field. Then click on the “Confirm” button. If, suddenly, you have not receive the SMS, then you can click on the button “Resend code”:

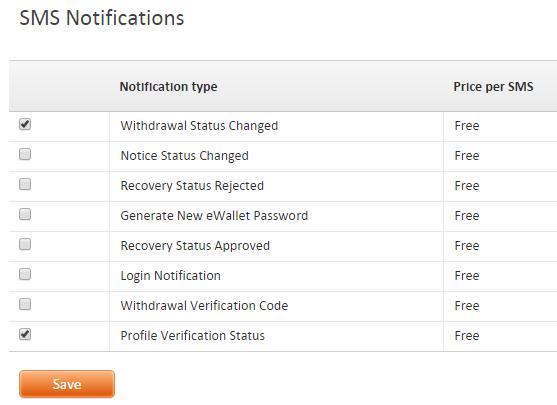

8) Also on this page “SMS notification” you can choose which types of notifications you want to receive from the broker via SMS to your mobile phone:

9) Now you need to open an FXOpen TickTrader ECN account, which will be used as your bonus trading account. Until you open the TickTrader ECN account, the broker will not transfer you the free bonus of $10. FXopen TickTrader ECN account is used for ECN-trading with access to the real market. The broker does not limit the work on this account in any way: it means, that you can use any strategy, automated trading, expert advisors, and strategies including scalping and hedging. Here you may see all conditions of this type of account:

To open an account, login MyFxopen and then go to the “Open account” section. There, move to the section “Trading Accounts” and select the “TickTrader ECN” type there. You will be asked to specify different parameters of this account, select the account currency, and the size of the leverage, and set the password for working from the phone. Set the required parameters, confirm and save all the necessary information about the new account: number, password, merchant server address, and password for investors’ access.

10) That’s all. If you have done everything in accordance with the above instructions, then the broker will transfer the sum of FXOpen no deposit bonus to the balance of an opened TickTrader ECN account and you can start trading.

Now some helpful information about the conditions of this forex welcome bonus. You can not withdraw the bonus, you can only withdraw profits that you will earn from your trading. To do this, you will have to trade at least 1 standard lots and that’s all. Also, I should note that the broker requires to verify the client’s personal data before the withdrawal’s request. If all of these conditions are met by you and you have traded at least 1 lots with profit, then you can request withdrawal of money from the account. You may withdraw money from FXOpen to purses in popular payment systems. By the way, to fund (deposit) money to your account balance you may use the same channels: WebMoney, Qiwi, Skrill, Neteller, Yoomoney, or bank cards/accounts. Of course, you may use for the withdrawal even crypto-currencies transfers.

FXopen review

Reliable forex broker FXOpen is known for its online trading services offered through the MetaTrader 4, MetaTrader 5, and TickTrader platforms. It differs from other forex brokers by the history of its origin. Founded in 2003 as a technical analysis education center in Egypt, it has evolved over time into a major Forex brokerage company experiencing rapid growth. FXOpen’s entry into the brokerage market in 2005 was a natural step, driven by the growing demand for fair trading conditions and quality customer support. Today, FXOpen is a well-established ECN broker, providing clients with a variety of account types, including ECN, STP, Micro, and crypto trading accounts, depending on the jurisdiction. The company is represented by offices in London, Cyprus, and Australia, all of which are regulated by the FCA, CySEC, and ASIC respectively.

FXOpen’s success is based on its innovative ECN technology for margin trading in the Forex market. Through a pool of participants that includes banks, centralized exchanges, large companies and private investors, FXOpen aggregates liquidity from various Tier 1 banks and non-bank liquidity providers, giving traders access to high liquidity and tight spreads. Real-time quotes are sourced from well-known liquidity providers such as Dresdner, SG Paris, Standard Chartered, Barclays Capital, Bank of America, CRNX, JPMorgan, Morgan Stanley, Deutsche Bank AG, RBS, CITI, UBS, HOTSPOT INST, GOLDMAN, and others, making it easy for clients to execute high-volume orders quickly and easily.

The broker supports the ability to transact in over 620 trading instruments and more than 600 stock CFDs.

FXOpen is constantly in development. In 2020, they launched the TickTrader platform, providing clients with comprehensive trading of Forex, Stocks, Commodities, Indices, and Cryptocurrencies via one special ECN TickTrader trading account. FXOpen has launched a number of services including PAMM accounts, ECN, MT4 Webtrader, and one-click trading since the market’s inception. The introduction of crypto accounts in 2014 demonstrated their ability to adapt to emerging financial markets.

FXOpen was the first to offer Islamic-compliant micro and swap-free accounts in 2006, demonstrating its commitment to innovation and customer satisfaction.

Is FXopen regulated?

The FXOpen brand operates under several organizations licensed by official regulatory bodies to ensure compliance and client protection.

- FXOpen AU Pty Ltd, headquartered in Perth, has been licensed and regulated by the Australian Securities and Investments Commission (AFSL 412871 – ABN 61 143 678 719) since July 2012. This license ensures that the company adheres to strict regulatory standards and provides a safe trading environment for Australian clients.

- FXOpen Ltd, based in London, has been regulated by the Financial Conduct Authority (FCA No. 579202) of the UK since March 2013. Obtaining an FCA license means that the company undergoes strict supervision and must follow FCA guidelines, allowing it to officially provide services to traders in the UK.

- FXOpen EU Ltd, headquartered in Limassol, Cyprus, is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 194/13. As regulated by CySEC, the company adheres to European financial regulations, ensuring a safe and transparent trading environment for clients in Europe.

Under the supervision of these reputable regulatory bodies, FXOpen ensures transparency, adherence to strict financial standards, and protection of client’s interests, making it a reliable and trustworthy forex broker.

FXopen account types

The broker offers an optimal range of live trading accounts designed for traders of all levels, from beginners to seasoned professionals. Each FXOpen real account type is designed for different trading styles, deposit sizes, and risk tolerance criteria:

- 1. FXOpen ECN Account

Business Model: ECN (Electronic Communication Network)

Minimum Deposit: Starting from $100

Maximum Balance: No limitations

Spread: Floating, starting from 0 pips

Commission (per 1 mio): Starting from $15

Execution: Market

Requotes/Slippage: No/Yes

Minimum Transaction Size: 0.01 lots

Maximum Transaction Size: No limitations

Open Trades Max: Not limited*

Leverage: Up to 1:500

Margin Call: 100%

Stop Out: 50%

Demo Accounts: Yes

Islamic Accounts: Yes

Instruments: 50+ FX Spot CFDs, 25+ Cryptocurrency CFDs, Shares CFDs, Index CFDs, Spot Metals CFDs, Commodity CFDs

Bonuses: No

Hedging: Yes

Expert Advisors: Yes

Scalping: Yes

News Trading: Yes

Phone Dealing: Yes

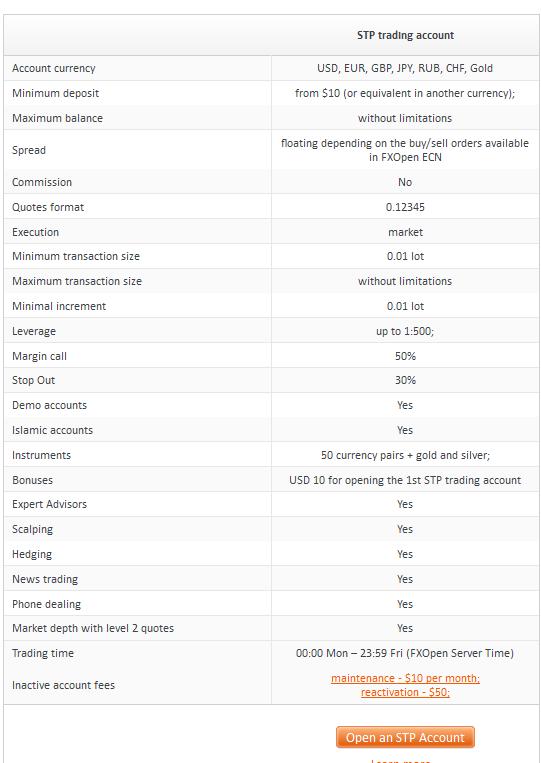

Market Depth with Level 2 Quotes: Yes - 2. FXOpen STP Account

Business Model: STP (Straight Through Processing)

Minimum Deposit: Starting from $10

Maximum Balance: No limitations

Spread: Floating

Commission (per 1 mio): No

Execution: Market

Requotes/Slippage: No/Yes

Minimum Transaction Size: 0.01 lots

Maximum Transaction Size: No limitations

Open Trades Max: Not limited*

Leverage: Up to 1:500

Margin Call: 50%

Stop Out: 30%

Demo Accounts: Yes

Islamic Accounts: Yes

Instruments: 50 currency pairs + gold and silver

Bonuses: Yes

Hedging: Yes

Expert Advisors: Yes

Scalping: Yes

News Trading: Yes

Phone Dealing: Yes

Market Depth with Level 2 Quotes: Yes - 3. FXOpen Crypto Account

Business Model: ECN

Minimum Deposit: Starting from $10

Maximum Balance: No limitations

Spread: Floating

Commission (per 1 mio round turn): 0.5% of trade volume

Execution: Market

Requotes/Slippage: No/Yes

Minimum Transaction Size: 0.01 lots

Maximum Transaction Size: No limitations

Open Trades Max: Not limited*

Leverage: 1:3

Margin Call: 30%

Stop Out: 15%

Demo Accounts: Yes

Islamic Accounts: No

Instruments: 43 pairs with BTC, LTC, EOS, PPC, ETH, DASH, EMC

Bonuses: No

Hedging: Yes

Expert Advisors: Yes

Scalping: Yes

News Trading: Yes

Phone Dealing: Yes

Market Depth with Level 2 Quotes: Yes - 4. FXOpen Micro Account

Business Model: MM (Market Maker)

Minimum Deposit: Starting from $1

Maximum Balance: $3,000

Spread: Floating

Commission (per 1 mio): No

Execution: Instant

Requotes/Slippage: Yes/No

Minimum Transaction Size: 0.01 microlots

Maximum Transaction Size: $1,000,000

Open Trades Max: Up to 100 trades open at the same time

Leverage: Up to 1:500

Margin Call: 20%

Stop Out: 10%

Demo Accounts: No

Islamic Accounts: Yes

Instruments: 28 currency pairs + gold and silver

Bonuses: Yes

Hedging: Yes

Expert Advisors: Yes

Scalping: Yes

News Trading: No

Phone Dealing: No

Market Depth with Level 2 Quotes: No

Choose the trading account that best suits your trading strategy, your capital size, and risk management, and start trading Forex via FX Open.

Trading platforms and instruments

Platforms

FXOpen supports 3 powerful trading platforms to meet the diverse needs of traders. Let’s take a look at each platform:

- TickTrader

TickTrader is an advanced platform designed to give traders a seamless multi-asset trading experience. It allows you to trade forex, stocks, commodities, indices, and cryptocurrencies from a single account. The TickTrader platform provides a customizable interface, advanced technical analysis tools, one-click trading, and Level 2 pricing to explore market depth. Traders can set up personalized alerts, access detailed charts, and test strategies on history to make better decisions. - Metatrader 5

MetaTrader 5 (MT5) is a versatile multi-asset platform that extends the capabilities of its predecessor, MT4. It supports netting and hedging accounting systems, various execution models, and all types of orders. MT5 offers a wide range of technical indicators, 21 timeframes, and up to 100 charts to assist in professional technical analysis. In addition, traders can access economic calendars and financial news for fundamental analysis. The platform also allows copy trading with trading signals and supports algorithmic trading with Expert Advisors. - Metatrader 4

FXOpen was the first broker to provide ECN trading via MetaTrader 4 (MT4) back in 2009. Today, it remains a popular choice among traders, offering instant and error-free order execution from multiple liquidity providers. MT4 is available in different modifications for STP and Micro accounts. The platform offers a user-friendly interface, technical analysis tools, and access to various financial markets. Traders can use MT4 on personal computers, mobile devices (iOS and Android) and web browsers for anytime, anywhere trading.

With a selection of advanced trading platforms, FXOpen ensures that traders have the tools they need to operate confidently and effectively in the financial markets.

Trading instruments

At FX Open, traders have access to a large list of financial trading instruments.

- Forex

With over 50 major and minor currency pairs, trade forex 24 hours a day, Sunday through Friday. As an ECN broker, FXOpen connects you with major banks and liquidity providers, providing competitive prices with spreads as low as 0.0 pips. The following trading pairs are available: EURUSD, USDCHF, GBPUSD, AUDUSD, USDJPY, USDCAD, EURCHF, EURGBP, EURJPY, GBPJPY, NZDUSD, AUDJPY, AUDNZD, EURAUD, EURCAD, GBPCHF, USDNOK, USDSEK, GBPCAD, CADCHF, USDCNH, USDRUB, USDMXN, USDPLN, USDTRY, EURTRY. - Indices

Trade global indices on any ECN account. Take advantage of low commissions, tight spreads, and flexible contract sizes. Trade popular indices such as UK 100, Japan 225, US Tech 100 (Mini), US SPX 500 (Mini), Wall Street 30 (Mini), Europe 50, France 40, Germany 40 (Mini), Australia 200, Hong Kong 50. - Commodities

Trade energy and metals markets with narrow spreads and fast execution. FXOpen’s ECN model gives you deep liquidity to work with commodities such as XAUUSD, XAGUSD, XBRUSD, XTIUSD, and US Natural Gas. - Shares

Gain exposure to leading US companies by trading stocks as CFDs on your MT4, MT5 or TickTrader ECN account. Trade well-known stocks such as Tesla, Apple, Facebook, Microsoft, Amazon, Netflix, Citigroup, Boeing Co, Goldman Sachs Group, NIKE, and more. - Cryptocurrencies

Trade on over 40 cryptocurrencies CFD markets 24/7 via MT4, MT5, or TickTrader terminals. Enjoy tight spreads and high liquidity for cryptocurrency pairs such as BTCEUR, BTCUSD, BTCGBP, BTCJPY, BTCCNH, LTCBTC, LTCEUR, LTCUSD, LTCJPY, XRPEUR, XRPUSD, XRPBTC, DSHBTC, DSHUSD, ETHBTC, ETHUSD, ETHEUR, ETHJPY, BCHUSD, BCHBTC, IOTBTC, ETCBTC, EOSBTC, EOSEUR, EOSGBP, EOSJPY, EOSUSD and more.

By choosing FXOpen as your true ECN broker, you can take advantage of competitive spreads, low commissions and fast execution across a wide range of financial instruments, making it an ideal choice for traders of all types and experience levels.

Deposit and withdrawal options

How to deposit FXOpen account?

The broker offers clients a large number of convenient and instant deposit options to fund FXOpen trading accounts. Deposits can be made in a variety of currencies and cryptocurrencies. Here are the available deposit options(fees, maximum and minimum deposit amount, available deposit method vary by currency type and jurisdiction):

- FasaPay (USD / IDR)

Accepted Currencies: USD (United States Dollar) / IDR (Indonesian Rupiah)

Commission & Fees: Free

Minimum Amount: 0.01 USD / 10,000 IDR

Maximum Amount: 75,000 USD / 700,000,000 IDR - AdvCash (EUR / GBP / USD)

Accepted Currencies: EUR (Euro) / GBP (British Pound) / USD (United States Dollar)

Commission & Fees: 0.5%

Minimum Amount: 3 EUR / GBP / USD

Maximum Amount: 1,000,000 EUR / GBP / USD - Bitcoin (BTC)

Accepted Currency: BTC (Bitcoin)

Commission & Fees: 0.0003 BTC

Minimum Amount: 0.001 BTC

Maximum Amount: 1,000,000 BTC - BitcoinCash (BCH)

Accepted Currency: BCH (BitcoinCash)

Commission & Fees: Free

Minimum Amount: 0.001 BCH

Maximum Amount: 10,000,000 BCH - Litecoin (LTC)

Accepted Currency: LTC (Litecoin)

Commission & Fees: Free

Minimum Amount: 0.01 LTC

Maximum Amount: 1,000,000 LTC - Ethereum (UST / ETH)

Accepted Currencies: UST (Terra USD) / ETH (Ethereum)

Commission & Fees: 5 UST / 0.001 ETH

Minimum Amount: 5 UST / 0.01 ETH

Maximum Amount: 1,000,000 UST / ETH - Tether (UST / USDT)

Accepted Currencies: UST (Terra USD) / USDT (Tether)

Commission & Fees: 5 UST / 5 USDT

Minimum Amount: 5 UST / USDT

Maximum Amount: 1,000,000 UST / USDT - Wire Transfer (USD / GBP / SGD / EUR / JPY / AUD / CHF)

Accepted Currencies: USD / GBP / SGD / EUR / JPY / AUD / CHF

Commission & Fees: Free

Minimum Amount: 25 USD / GBP / SGD / EUR / JPY / AUD / CHF

Maximum Amount: 1,000,000 USD / GBP / SGD / EUR / JPY / AUD / CHF - Credit/Debit Cards (Maestro / MasterCard / Visa / Visa Electron) – (USD / EUR)

Commission & Fees: 5.5% + 0.5 USD / 5.5% + 0.45 EUR

Minimum Amount: 5 USD / EUR

Maximum Amount: 5,000 USD / 3,750 EUR - Skrill (USD / GBP / EUR / AUD)

Commission & Fees: 3.9% + 0.29 USD / 3.9% + 0.24 GBP / 3.9% + 0.43 AUD / 125.64%

Minimum Amount: 2 USD / GBP / EUR / AUD

Maximum Amount: 50,000 USD / GBP / EUR / AUD - Neteller (USD / GBP / AUD / EUR)

Commission & Fees: 3.9% + 0.29 USD / 3.9% + 0.24 GBP / 3.9% + 0.43 AUD / 125.64%

Minimum Amount: 2 USD / 2 GBP / 3 AUD / 2 EUR

Maximum Amount: 50,000 USD / 32,000 GBP / 57,000 AUD / 40,000 EUR

You can check the deposit options available to you in your cabinet after logging into my.fxopen.com.

How to withdraw money from FXOpen?

The broker offers a variety of fast and convenient options for withdrawing funds from trading accounts. Fxopen withdrawal options (fees, maximum and minimum withdrawal amount, available withdrawal method depending on the currency type and jurisdiction):

- Paypaid (THB)

Accepted Currency: THB (Thai Baht)

Commission & Fees: 2%

Minimum Amount: 10 THB

Maximum Amount: 10,000,000 THB - WebMoney (USD / EUR)

Accepted Currencies: USD (United States Dollar) / EUR (Euro)

Commission & Fees: 0.8%

Minimum Amount: 1.01 USD / EUR

Maximum Amount: 100,000 USD / EUR - FasaPay (USD / IDR)

Accepted Currencies: USD (United States Dollar) / IDR (Indonesian Rupiah)

Commission & Fees: 0.5%

Minimum Amount: 1 USD / 10,000 IDR

Maximum Amount: 25,000 USD / 250,000,000 IDR - AdvCash (USD / EUR)

Accepted Currencies: USD (United States Dollar) / EUR (Euro)

Commission & Fees: 0.5%

Minimum Amount: 1 USD / EUR

Maximum Amount: 1,000,000 USD / EUR - Bitcoin (BTC)

Accepted Currency: BTC (Bitcoin)

Commission & Fees: 0.001 BTC

Minimum Amount: 0.001 BTC

Maximum Amount: 1,000,000 BTC - BitcoinCash (BCH)

Accepted Currency: BCH (BitcoinCash)

Commission & Fees: 0.0005 BCH

Minimum Amount: 0.001 BCH

Maximum Amount: 10,000,000 BCH - Litecoin (LTC)

Accepted Currency: LTC (Litecoin)

Commission & Fees: 0.005 LTC

Minimum Amount: 0.01 LTC

Maximum Amount: 1,000,000 LTC - Emercoin (EMC)

Accepted Currency: EMC (Emercoin)

Commission & Fees: 0.1 EMC

Minimum Amount: 0.2 EMC

Maximum Amount: 10,000,000 EMC - Ethereum (UST / ETH)

Accepted Currencies: UST (Terra USD) / ETH (Ethereum)

Commission & Fees: 0.005 ETH / 15 UST

Minimum Amount: 0.01 ETH / 30 UST

Maximum Amount: 1,000,000 ETH / UST - Tether (USDT / UST)

Accepted Currencies: USDT (Tether) / UST (Terra USD)

Commission & Fees: 15 USDT / 15 UST

Minimum Amount: 30 USDT / UST

Maximum Amount: 1,000,000 USDT / UST - Wire Transfer (GBP / JPY / SGD / AUD / CHF / EUR / USD / AUD)

Accepted Currencies: GBP (British Pound) / JPY (Japanese Yen) / SGD (Singapore Dollar) / AUD (Australian Dollar) / CHF (Swiss Franc) / EUR (Euro) / USD (United States Dollar) / AUD (Australian Dollar)

Commission & Fees: 20 GBP / 3,000 JPY / 40 SGD / Free / 30 CHF / 25 EUR / 30 USD / AUD

Minimum Amount: 69 GBP / JPY / SGD / AUD / CHF / EUR / USD / AUD

Maximum Amount: 1,000,000 GBP / JPY / SGD / AUD / CHF / EUR / USD / AUD - Credit/Debit Cards (MasterCard / Maestro / Visa / Visa Electron) – (USD / EUR)

Commission & Fees: 2.5% + 3.5 USD / 2.5% + 3.5 EUR

Minimum Amount: 10 USD / EUR

Maximum Amount: 5,000 USD / 3,750 EUR - Skrill (EUR / USD / AUD / GBP)

Commission & Fees: 1% / 150%

Minimum Amount: 2 EUR / USD / AUD / GBP

Maximum Amount: 15,000 EUR / USD / AUD / GBP - Neteller (EUR / AUD / USD / GBP)

Commission & Fees: 2% / 150%

Minimum Amount: 2 EUR / 3 AUD / 2 USD / 2 GBP

Maximum Amount: 8,000 EUR / 11,500 AUD / 10,000 USD / 6,500 GBP

With these various withdrawal options, clients can easily and efficiently withdraw from FXOpen trading accounts.

FxOpen PAMM accounts

FXOpen PAMM service facilitates copying trades from a Master account to one or more Followers, optimizing profit/loss distribution. The Master manages his personal funds in a special PAMM account, and his trading strategy is copied to the Followers’ own funds.

With the PAMM service Followers get a number of advantages, including the ability to manage their own funds and send customized offers to the Master. Automatic distribution of profits/losses and commissions ensures fair and transparent relationships, eliminating concerns about unfairness or delays in payments.

The PAMM service provides publicly available monitoring and trading charts, allowing Followers to select Masters based on risk attitude and profitability. Comprehensive evaluation tools and ratings of PAMM accounts allow both experienced and novice Followers to easily find the most suitable Master.

For Masters, the PAMM service offers flexibility by allowing them to create several Offers with different conditions for Followers with different risk profiles. Master can open 3 types of MT4-based PAMM accounts – PAMM STP, PAMM ECN and PAMM Crypto. The system automatically processes the results, ensuring that each party receives its fair share of income depending on the proportion of funds allocated.

In addition, the PAMM service presents visual and user-friendly monitoring systems to help potential Followers make informed decisions based on past trading results of the Masters.

Overall, FXOpen PAMM service serves as a bridge connecting experienced traders (Masters) with people interested in financial markets (Followers) around the world, facilitating mutually beneficial cooperation.

Frequently Asked Questions

FXOpen verification passing

Until personal information will be verified, the status “Not verified” will be shown in your My FXOpen area. To verify the data, you will need to upload scans of your documents. You may upload your docs through the personal data section at My FXOpen. You should go there to the section “Verification eWallet”. You should scan or take a photo of 2 documents that may approve your identity and your residential address. As always, the usual national passport, international passport, or driver’s license may be used to verify the identity. To verify the residential address, you will need to use utility bills or a bank statement. After uploading the documents, you will need to wait about 3 working days until the broker’s support will check them.

If everything will be ok, then the status “Not verified” will be removed.

Problem with My FXOpen login

It’s quite an easy process to log in to my fxopen area. You should use for it your registration email and password. If you will forget your password or login information, then you will need to pass through the recovery procedure. So, the official site page for fxopen login is situated at this address https://my.fxopen.com/en/Login.

What is the FXOpen minimum deposit

The FXOpen minimum deposit is only $1 for Micro trading accounts in international jurisdictions. For EU, UK, and AU residents the minimal initial deposit for FXOpen is 300 USD/GBP/EUR.

How to contact the broker?

FXOpen EU contacts:

38 Spyrou Kyprianou Street, CCS BLDG – Office N101, 4154 Limassol, Cyprus

support@fxopen.eu

+35725024000

FXOpen UK (United Kingdom and Middle East residents) contacts:

80 Coleman Street, London, EC2R 5BJ, United Kingdom

support@fxopen.co.uk

+44(0)2035191224

FXOpen AU contacts:

Level 25 108 St Georges Terrace Perth WA 6000 Australia

support@fxopen.com.au

+61865578587

FXOpen International contacts:

P.O. Box 590, Springates East, Government Road, Charlestown, Nevis

+6498010123

How can I change my eWallet currency?

You do not need to register new FXOpen e-wallet as it supports multiple currencies. It allows you to store funds in different currencies in one e-wallet at the same time. The default currency you currently see will be changed when you deposit money into Fx open. If, for example, you make a deposit to FXOpen e-wallet in Australian Dollars, US Dollars and Euros, they will be displayed in your account in the respective currency without the need for conversion.

In conclusion, FXOpen is a reputable forex broker with a rich history of growth and innovation, offering traders around the world a variety of trading solutions and cutting-edge technology. Their commitment to transparency, continuous improvement, and dedication to innovation has solidified their position as a trusted leader in the Forex industry.

I would like to share my experience.

I have been actively trading on FXOpen for the last three years. FXOpen, known for its highly competitive spreads, has proven to be the best choice for me as a scalper. The Fxopen STP account, created with my needs in mind, proved to be the most suitable option for my trading. During the trading day, I observed minimal slippage in the EUR/USD pair, which increased the stability of my trades. Despite occasional minimal slippage during periods of increased market volatility, especially when important news events occur, my working approach is to be patient and avoid taking unnecessary risks in my trading. This approach provides me with risk-free trading. Notably, I have not encountered any difficulties related to withdrawals and trading operations.

The undeniable advantage of FXOpen for me is the extensive choice of trading instruments. To summarize, my cooperation with FXOpen has been and remains incredibly profitable.